FINRA SERIES 7 EXAM PREP

Pass the Series 7

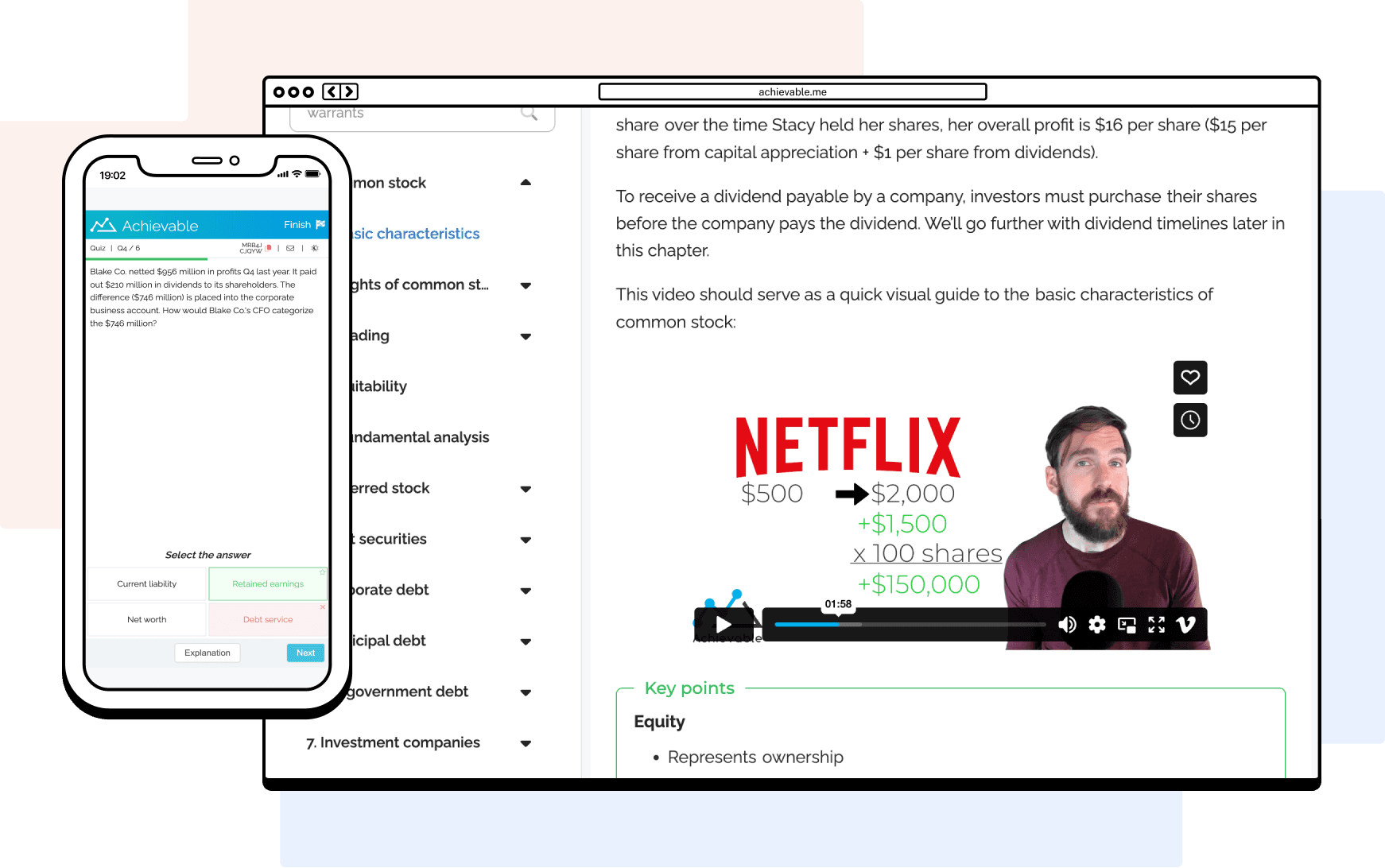

Whether you're aiming to become a financial advisor or renewing a lapsed license, Achievable's interactive online Series 7 exam prep course makes complex topics simple and engaging. Our adaptive platform personalizes your study plan for effective Series 7 prep.

Achievable exam prep includes our easy-to-understand online textbook, 3,700+ quiz questions, and 35+ full-length practice exams.

You'll love studying with Achievable

Thousands of people trust Achievable exam prep to help them pass their most important exams

95%+

Success rate

50M+

Questions answered

2M+

Hours studied

Hello future students, this study guide was nice. I enjoyed reading through the material. I hope you pass the exam!

Been studying for this for a week and this helped me more than the 300-page textbook I read. Thank you. I've been studying for these exams for almost 6 months and have been SO confused. Now I understand! Wow! you made it so clear! Thank you so much!

I used achievable for practice taking the exam. The score break down is very helpful and gives great explanations

Achievable is the best resource I've found. More so than with [competitor], or [competitor] I find the material "sticks" with Achievable's system of introducing new material, followed by review quizzes to master previous readings. It's incredibly easy to use, anywhere you are (at home on a desktop, laptop, or away with your mobile device) and actually interesting to read. Every other guide I've tried reads like stereo instructions.

This is a good subscription, really enjoyed the prep. would definitely suggest to a friend

I am pleasantly surprised at the quantity and quality of information supplied by achievable. I was skeptical at first, but after spending time with them I i highly recommend using them. If you are looking for more detailed information I would suggest looking somewhere else, but honestly all you need are the basics.

Excellent platform! Super easy to use and it takes the stress out of preparing for the exam. So glad that I found this!

I like this way of learning so far better. I have the [competitor] training material and fund it so hard to follow

Stand out when applying for your dream job

Thousands of people succeed with Achievable and go on to amazing companies.

We're proud to point out that our students have landed great jobs, but we're required to note that Achievable is not affiliated with or endorsed by these firms.

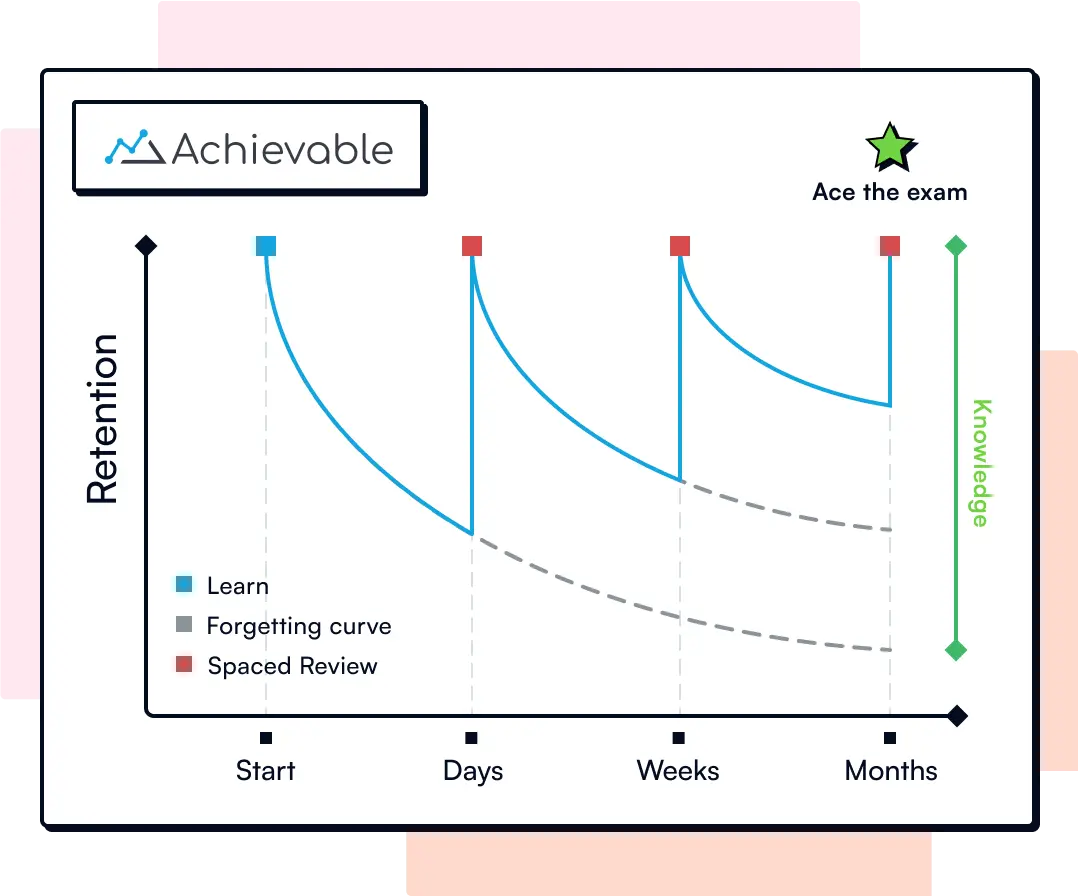

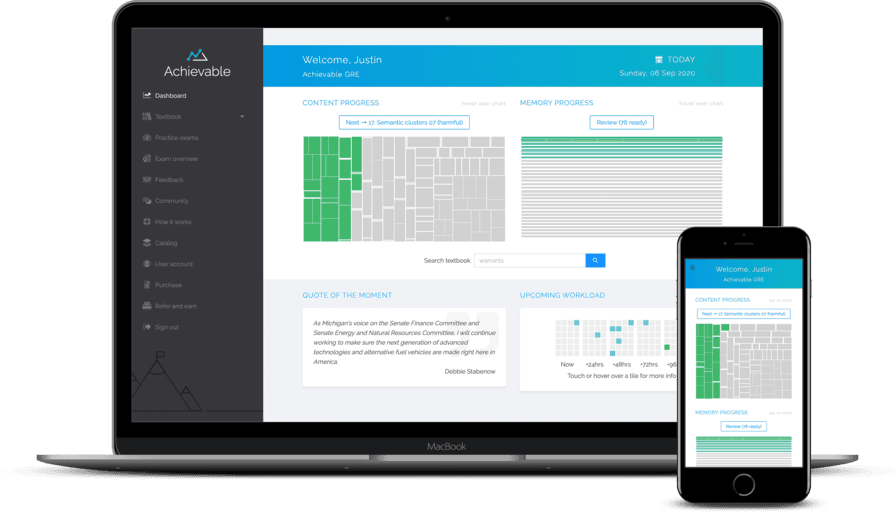

Advanced personalization

Achievable Series 7 exam prep uses adaptive learning techniques to create and update a personalized model of your memory, individually tracking your retention and mastery of each FINRA Series 7 exam learning objective. Our learning engine monitors your study progress and continually adjusts your quiz questions to ensure you're focusing on the topics that matter most for you, improving study effectiveness while reducing overall study time.

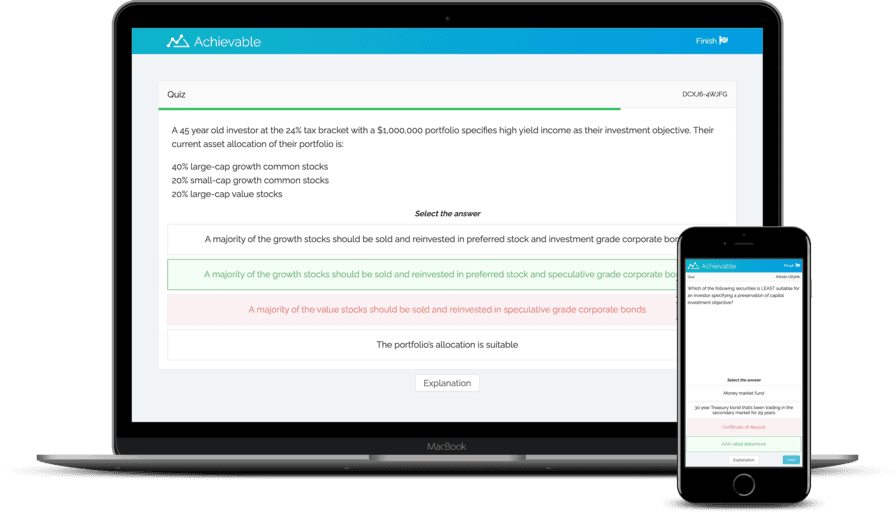

Full-length practice exams

With 3,700+ high-quality hand-crafted FINRA Series 7 practice exam questions, you can take 35+ full-length practice exams. Our Series 7 practice questions include all the types of questions you'll see on the exam, and they're weighted according to the official FINRA Series 7 exam rubric so you can have confidence in your scores. Furthermore, our math-based questions are templatized so that you see different numbers each time, ensuring that you're learning the underlying concept and not just the right answer.

Review quizzes

Continually reviewing the material you've learned while studying is essential, but you need more than simple Series 7 flashcards. In addition to our full-length practice exams, our Series 7 exam study materials include a separate quiz bank of 3,700+ review questions so you can quickly drill the key facts and regulations for any particular chapter.

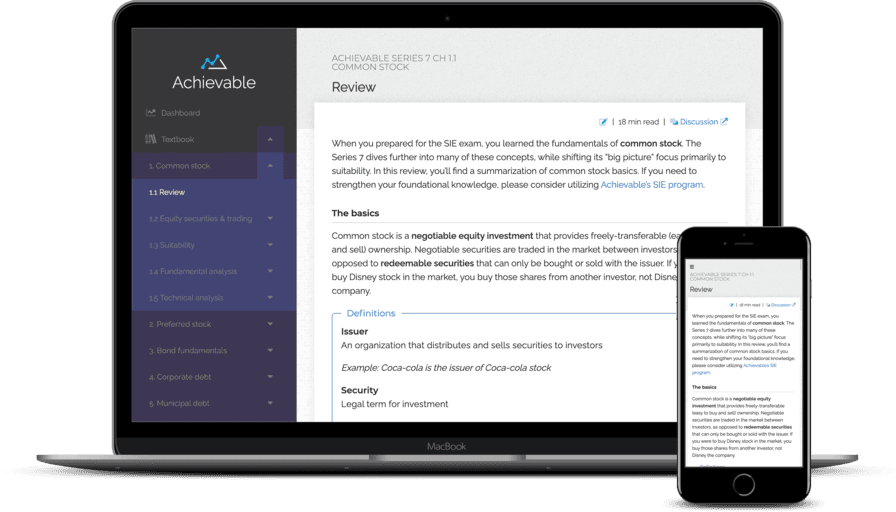

Easy-to-understand online textbook

You'll see within minutes why our full online Series 7 exam prep book is the best Series 7 exam prep - it's easy to understand and written in plain English, filled with straightforward explanations and real-world examples. Our expert author has 15+ years of licensing experience, and it shows. Achievable Series 7 study materials are easy to read, mobile friendly, and include detailed walkthroughs of sample questions. Each of the FINRA Series 7 sections are covered in detail in our Series 7 online course.

Videos on key topics

Achievable is an effective and efficient quiz-focused course - you won't have to sit through 100+ hours of boring Series 7 video lectures! Our courses have a reputation for being easy to understand. If you're a visual learner, we have you covered: we include bonus Series 7 explainer videos on key topics to ensure you can fully understand complicated concepts.

Narrated audio

Press play and let the course come alive in your headphones. Adjustable voices and playback speed let you cruise through familiar chapters or slow down for tricky topics, turning every commute or workout into quality study time. Hearing concepts activates a different part of your memory, boosting retention without adding extra study hours.

Ask Achievable

AI Tutor

Stuck on a regulation or formula? Our AI tutor replies immediately with clear explanations and real-world examples so you never lose momentum. Most AI tools guess. Achievable AI knows. Ask Achievable AI is fine-tuned to the exam's structure, content, terminology, and common pitfalls; it's an expert, supportive, and always-on study buddy.

Meticulously human-crafted

High-quality study materials start with expert authorship. Every Achievable course is hand-crafted by a team of seasoned professionals with deep industry experience, then continually reviewed and refined to reflect the most recent exam standards.

Researchers have tried to train AI to pass these nuanced exams - and failed. We love AI and deeply integrate it into our platform to provide a personalized study experience, but AI cannot replace the thoughtful insight of human authors. Don't risk your future on cheap, AI-generated slop.

Modern platform

Whether you're studying on the web or a smartphone, the Achievable FINRA Series 7 exam prep platform UX is clean and responsive. Progress charts highlight your journey through the Series 7 course content and your current strength in each section.

Proven success

With Achievable, you will pass. The effectiveness of our courses is empirically validated with 2,000,000+ hours studied and 50,000,000+ quiz questions answered.

Controlled experimental studies with our corporate customers demonstrate that using Achievable results in ~15% higher scores, translating into significantly higher pass rates and career success.

Pass the FINRA Series 7. Guaranteed.

Achievable is the best Series 7 exam prep course: effective, personalized, and convenient. With Achievable, you'll spend less time studying and pass your exam the first time, or your money back.