FINRA SERIES 6 EXAM PREP

Pass the Series 6

Whether you're looking to become an Investment Company and Variable Contracts Products Representative or renewing a lapsed license, Achievable is the best and most effective Series 6 exam prep on the market.

Achievable exam prep includes our online textbook, review questions, and full-length practice exams.

You'll love studying with Achievable

Thousands of people trust Achievable exam prep to help them pass their most important exams

95%+

Success rate

50M+

Questions answered

2M+

Hours studied

Easy to use and breaks down the test in easy to understand language. Worth it and I feel a lot more comfortable and ready for my exam!

Achievable is the best resource I've found. More so than with [competitor], or [competitor] I find the material "sticks" with Achievable's system of introducing new material, followed by review quizzes to master previous readings. It's incredibly easy to use, anywhere you are (at home on a desktop, laptop, or away with your mobile device) and actually interesting to read. Every other guide I've tried reads like stereo instructions.

This is a great tool for studying to pass the exam.

Been studying for this for a week and this helped me more than the 300-page textbook I read. Thank you. I've been studying for these exams for almost 6 months and have been SO confused. Now I understand! Wow! you made it so clear! Thank you so much!

This is great it has everything I need and everything is so intuitive and helpful it's just so so so so great.

I am pleasantly surprised at the quantity and quality of information supplied by achievable. I was skeptical at first, but after spending time with them I i highly recommend using them. If you are looking for more detailed information I would suggest looking somewhere else, but honestly all you need are the basics.

I like this way of learning so far better. I have the [competitor] training material and fund it so hard to follow

This has helped me tremendously. The on hands learning with videos as well is a different type of mental learning.

Stand out when applying for your dream job

Thousands of people succeed with Achievable and go on to amazing companies.

We're proud to point out that our students have landed great jobs, but we're required to note that Achievable is not affiliated with or endorsed by these firms.

Advanced personalization

Achievable Series 6 exam prep uses adaptive learning techniques to create and update a personalized model of your memory, individually tracking your retention and mastery of each FINRA Series 6 exam learning objective. Our learning engine monitors your study progress and continually adjusts your quiz questions to ensure you're focusing on the topics that matter most for you, improving study effectiveness while reducing overall study time.

Full-length practice exams

With hundreds of high-quality hand-crafted FINRA Series 6 practice exam questions, you can take 35+ full-length practice exams. Our Series 6 practice questions include all the types of questions you'll see on the exam, and they're weighted according to the official FINRA Series 6 exam rubric so you can have confidence in your scores.

Review quizzes

Continually reviewing the material you've learned while studying is essential, but you need more than simple Series 6 flashcards. In addition to our full-length practice exams, our Series 6 exam study materials include a separate quiz bank of 800+ review questions so you can quickly drill the key facts and regulations for any particular chapter.

Easy-to-understand online textbook

You'll see within minutes why our full online Series 6 exam prep book is the best Series 6 exam prep - it's easy to understand and written in plain English, filled with straightforward explanations and real-world examples. Our expert author has 15+ years of licensing experience, and it shows. Achievable Series 6 study materials are easy to read, mobile friendly, and include detailed walkthroughs of sample questions. Each of the FINRA Series 6 sections are covered in detail in our Series 6 online course.

Videos on key topics

Achievable is an effective and efficient quiz-focused course - you won't have to sit through 100+ hours of boring Series 6 video lectures! Our courses have a reputation for being easy to understand. If you're a visual learner, we have you covered: we include bonus Series 6 explainer videos on key topics to ensure you can fully understand complicated concepts.

Narrated Audio

Press play and let the course come alive in your headphones. Adjustable voices and playback speed let you cruise through familiar chapters or slow down for tricky topics, turning every commute or workout into quality study time. Hearing concepts activates a different part of your memory, boosting retention without adding extra study hours.

Ask Achievable

AI Tutor

Stuck on a regulation or formula? Our AI tutor replies immediately with clear explanations and real-world examples so you never lose momentum. Most AI tools guess. Achievable AI knows. Ask Achievable AI is fine-tuned to the exam's structure, content, terminology, and common pitfalls; it's an expert, supportive, and always-on study buddy.

Modern platform

Whether you're studying on the web or a smartphone, the Achievable FINRA Series 6 exam prep platform UX is clean and responsive. Progress charts highlight your journey through the Series 6 course content and your current strength in each section.

Proven success

With Achievable, you will pass. The effectiveness of our courses is empirically validated with 2,000,000+ hours studied and 50,000,000+ quiz questions answered.

Controlled experimental studies with our corporate customers demonstrate that using Achievable results in ~15% higher scores, translating into significantly higher pass rates and career success.

How to get your Series 6

The first step to getting a Series 6 license is to pass the FINRA SIE Exam - or to have been grandfathered in by holding a FINRA representative-level registration on October 1, 2018. See our Achievable SIE program for more info.

The second step to getting your Series 6 license is to be sponsored by a FINRA-registered firm or a self-regulatory organization (SRO), typically your employer. After that, all you need to do is study and pass the test.

What's covered on the Series 6?

The Series 6 exam - the Investment Company and Variable Contracts Products Representative Qualification Examination (IR) - is designed to test the competency of an entry-level candidate to perform their job as an investment company and variable contracts products representative. Passing the Series 6 is required for representatives to sell these products.

Topic

Test questions

Seeks Business for the Broker-Dealer from Customers and Potential Customers

12 (24%)

Opens Accounts After Obtaining and Evaluating Customers' Financial Profile and Investment Objectives

8 (16%)

Provides Customers with Information About Investments, Makes Recommendations, Transfers Assets, and Maintains Appropriate Records

25 (50%)

Obtains and Verifies Customers' Purchase and Sales Instructions; Processes, Completes and Confirms Transactions

5 (10%)

When you buy the Achievable Series 6 course, you'll get access to our extensive question bank of 800+ chapter quizzes and 35+ practice exams.

Our practice exams are carefully constructed to match what you'll see on the actual Series 6, based on over a decade of training experience. Furthermore, our math-based questions are templatized so that you see different numbers each time, ensuring that you're learning the underlying concept and not just the right answer.

Series 6 exam details

The Series 6 exam - the Investment Company and Variable Contracts Products Representative Qualification Examination (IR) - is designed to test the competency of an entry-level candidate to perform their job as an investment company and variable contracts products representative. The exam seeks to measure the degree to which each candidate can perform the critical functions of such a representative, and ensure that all proper rules and regulations are followed in the candidate's execution of the role.

The Series 6 exam was created to qualify candidates as Investment Company and Variable Contracts Products representatives. The exam seeks to measure the degree to which each candidate can perform the critical functions of such a representative, and ensure that all proper rules and regulations are followed in the candidate's execution of the role.

The Series 6 exam is hosted by FINRA and costs $75 to register. Participants have 1 hour 30 minutes to answer 50 multiple-choice questions. The passing score is 70% (35/50).

Eligibility and sponsorship

The Series 6 has a co-requisite for licensing with the Securities Industry Essentials (SIE) exam. Both exams must be completed in order to become fully licensed with your FINRA Series 6.

You need to be sponsored by a FINRA member firm or a self-regulatory organization (SRO), typically your employer, in order to register for and take the Series 6 exam. You will also need to fill out and submit Form U4, which can be found on and submitted electronically on FINRA's website.

Administration of the exam

The Series 6 exam is administered via computer. A tutorial on how to take the exam is provided prior to taking the exam.

Each candidate's exam includes 5 additional, unidentified pretest items that do not contribute toward the candidate's score. The pretest items are randomly distributed throughout the exam. Therefore, each candidate's exam consists of a total of 55 items (50 scored and 5 unscored).

There is no penalty for guessing. Therefore, candidates should attempt to answer all items.

Candidates will be allowed 90 minutes to complete the Series 6 exam.

Candidates are not permitted to bring reference materials to their testing session. Severe penalties are imposed on candidates who cheat or attempt to cheat on FINRA-administered exams.

Scoring of the exam

All candidate test scores are placed on a common scale using a statistical adjustment process known as equating. Equating scores to a common scale accounts for the slight variations in difficulty that may exist among the different sets of exam items that candidates receive. This allows for a fair comparison of scores and ensures that every candidate is held to the same passing standard regardless of which set of exam items they received.

FINRA's Series 6 exam summary

Seeks Business for the Broker-Dealer from Customers and Potential Customers

24%

12 questions

Contacting current and potential customers by any method. Developing promotional and advertising material, and seeking appropriate approvals to distribute them. Describing investment products and services to current and potential customers with the intent of soliciting business.

Opens Accounts After Obtaining and Evaluating Customers' Financial Profile and Investment Objectives

16%

8 questions

Informing customers of the types of accounts and providing appropriate disclosures. Obtaining and updating customer information and documentation, including required legal documents and suspicious activity. Obtaining customer investment profile information. Obtaining required supervisory approvals.

Provides Customers with Information About Investments, Makes Recommendations, Transfers Assets, and Maintains Appropriate Records

50%

25 questions

Providing customers with investment strategies, risks and rewards, and relevant market and investment research data. Reviewing customer investment profiles to determine investment recommendations. Providing required disclosures regarding investment products and their risks. Communicating with customers about their accounts and maintaining documentation.

Obtains and Verifies Customers' Purchase and Sales Instructions; Processes, Completes and Confirms Transactions

10%

5 questions

Providing current quotes, processing and confirming customer transactions including regulatory requirements, and informing customers of delivery obligations and settlement procedures. Informing the appropriate supervisor and assisting in resolution of disputes or errors.

Achievable Series 6 content outline

1

Introduction

Introduction to the Series 6 exam.

2

Common stock

General characteristics and suitability of common stock investments, how to analyze value through fundamental analysis, and options.

3

Preferred stock

General characteristics and suitability of preferred stock investments, dividend yields, and additional features.

4

Debt securities

General characteristics and suitability of debt securities, impact of interest rates on market prices and yields, duration, and volatility.

5

Corporate debt

Types of corporate debt securities, various bank securities, and suitability.

6

Municipal debt

Types of municipal debt securities and suitability.

7

US government debt

Types of US government debt, agency mortgage-backed securities, and suitability.

8

Investment companies

Legal definition and regulation of investment companies, plus the general characteristics and suitability of open-end (mutual) funds, closed-end (publicly traded) funds, exchange traded funds (ETFs), and unit investment trusts (UITs).

9

Insurance products

General characteristics and suitability of fixed annuities, variable annuities, and variable life insurance products.

10

The primary market

General characteristics and regulations of the primary market. The rules of the Securities Act of 1933, which include IPO rules, exemptions, and the registration process.

11

The secondary market

Essentials of the secondary market, which is governed by the Securities Exchange Act of 1934. Specific stock markets, participants in the financial markets, order types, and applicable regulations.

12

Brokerage accounts

How brokerage accounts work, the process of opening one, and the different types of accounts available. Cash accounts, margin accounts, fiduciary accounts, and rules relating to firms offering brokerage accounts.

13

Retirement & education plans

Structures of ERISA-governed qualified and non-qualified retirement plans. Education plans (Coverdell ESPs and 529s), ABLE accounts, contribution limits, penalties, and suitability for specific plans.

14

Rules & ethics

The do's and don'ts of finance, specifically relating to registered representatives. Public communications, disclosure requirements, best practices, and ethical obligations to clients.

15

Suitability

High level review of suitability standards when making recommendations to clients. Product summaries, investment objectives, investor profiles, best practices when making recommendations, and test taking skills.

FINRA Series 6 resources

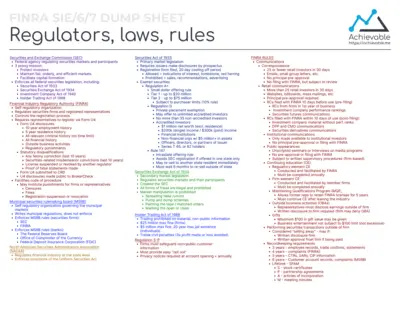

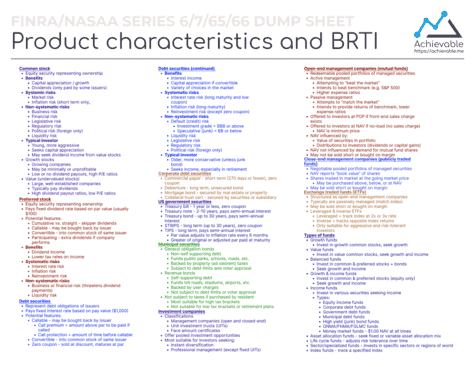

Check out our free Series 6 cheat sheets / Series 6 dump sheets and podcasts to help you prepare for the FINRA Series 6 exam or for a quick refresher on the Series 6 fundamentals.

Series 6 tutoring

Want one-on-one help with your studying? Check out Achievable's directory of FINRA Series 6 tutors.

Free FINRA Series 6 practice exam

Solve 10 free Series 6 practice exam questions to get a feel for what to expect on the actual Series 6 exam.

Achievable's FINRA podcast

FINRA course author Brandon Rith and guests provide actionable tips and topic reviews to help you pass your FINRA exams.

Dump sheet: Products, suitability

Quick reference sheet ("cheat sheet") for the Series 6 covering products and suitability.

Achievable Series 6 - $129

Pass the FINRA Series 6 on your first try with Achievable's interactive online exam preparation course. Includes everything you need: easy-to-understand online textbook, 800+ chapter review quizzes, and 35+ full-length practice exams.

Easy-to-understand online textbook

800+ chapter quizzes

35+ practice exams

14+ bonus videos

Learn from the best

Our content was written exclusively for Achievable by Basic Wisdom's acclaimed FINRA instructor Brandon Rith. With 15 years of finance-related experience and 10 years of licensing expertise, Brandon has helped thousands of learners successfully pass FINRA/NASAA exams while working for Fidelity Investments, where his programs posted pass rates that always exceeded company goals.

Pass the FINRA Series 6. Guaranteed.

Achievable is the best Series 6 exam prep course: effective, personalized, and convenient. With Achievable, you'll spend less time studying and pass your exam the first time, or your money back.