Explore careers in P&C and Personal Lines Insurance

Table of contents

- What is Property & Casualty insurance?

- What are Personal Lines?

- Types of insurance jobs in P&C and Personal Lines

- Common jobs in Property & Casualty insurance

- Claims adjuster

- Insurance agent

- Underwriter

- Licensing and compliance coordinator

- Customer Service Representative (CSR)

- Which roles typically fall under Personal Lines?

- Personal Lines insurance agent

- Customer Service Representative

- Claims support or adjuster - Personal Lines

- Personal Lines Underwriter

- Personal Lines licensing assistant

- Remote job opportunities in insurance

- Common remote insurance jobs:

- Why does insurance work so well remotely?

- What do you need to get started?

- What licenses are required?

- How to get licensed:

- Conclusion

The insurance industry can be complex, especially when it comes to understanding what you need to protect and the type of coverage required. At the core of this field are two principal categories: property and casualty insurance (often abbreviated as P&C insurance) and personal lines insurance. Gaining a solid grasp of these types of insurance is essential for anyone seeking a P&C or personal lines insurance license or preparing for an insurance exam, as these foundational concepts are key to navigating the industry with confidence.

What is Property & Casualty insurance?

Property and Casualty insurance encompasses a broad range of policies designed to protect individuals and businesses from financial losses and liabilities. At its core, P&C insurance safeguards against loss or damage to owned assets, such as houses, cars, or business property, as well as liability for incidents where the policyholder is found responsible for causing harm or damage to others.

Typically, property and casualty insurance includes essential coverages like:

- Business and commercial property insurance

- Auto insurance policies

Obtaining a property and casualty insurance license requires passing the P&C insurance licensing exam, reflecting the expertise required to advise clients about these coverages. With robust property and casualty insurance in place, policyholders can better manage risks, recover from unexpected losses, and maintain financial security.

What are Personal Lines?

Personal Lines is a part of P&C, focusing solely on individuals and families. These are the kinds of insurance most people use in their daily lives, including:

- Motorcycle insurance

- Car insurance

- Renters’ insurance

- Pet insurance

Coverage falls under personal lines if it’s meant to protect your personal property or personal liability.

Types of insurance jobs in P&C and Personal Lines

Now that we’ve clarified what P&C and Personal Lines cover, let’s explore the range of P&C insurance jobs that power this dynamic industry. Whether you’re interested in customer-facing positions, prefer behind-the-scenes roles, or are seeking remote opportunities, P&C insurance jobs offer diverse career paths to match your skills and preferences. No matter your work style, there’s likely a solid fit for you in the world of P&C insurance jobs.

Common jobs in Property & Casualty insurance

These roles exist across both the personal and commercial lines, and they form the core of most insurance companies.

Claims adjuster

When someone files a claim, such as a car accident or home damage, a claim adjuster steps in to investigate what has truly happened and determines how much the insurance company should pay. You will need strong attention to detail and empathy, particularly when assisting individuals through challenging situations.

Insurance agent

Agents help people choose the right and appropriate insurance policies, explain the coverage options, and manage the renewals. There are two types of agents:

- Captive agents: Those who work for one company

- Independent agents: Those who can offer policies from multiple companies

Underwriter

They determine the level of risk associated with insuring an individual or entity and establish the terms of the policy. It is a great role for problem-solvers who enjoy evaluating data and making decisions that strike a balance between risk and fairness.

Licensing and compliance coordinator

These professionals handle the behind-the-scenes paperwork and state licensing requirements that keep the agents and policies compliant. It is a good fit for organized and detail-oriented people.

Customer Service Representative (CSR)

They are the go-to when policyholders have questions about their coverage, billing, or claims. This is one of the most remote-friendly roles in the industry, and it is a great entry point.

Which roles typically fall under Personal Lines?

Suppose you are interested in personal lines insurance jobs and enjoy helping individuals and families protect what matters most. A career in personal lines insurance jobs could be the perfect choice for you. Like many roles in this area, positions in personal lines insurance are highly customer-focused and often allow for fully remote work, depending on the employer. Some of the most common personal lines insurance jobs include:

Personal Lines insurance agent

This is one of the most visible roles in the industry. Personal Lines agents help individuals select the right auto, home, or other policy, understand their coverage, and make adjustments to their policies as needed. This is an ideal role for individuals who are effective communicators and enjoy working directly with people.

Customer Service Representative

Many large insurance companies hire CSRs who specialize in personal lines. As a CSR in personal lines, your job is to help people update their personal information, make policy changes, and get answers about coverage, claims, and so on. It is a supportive role with a lot of interaction, but from behind the scenes. Many CSRs work entirely from home after completing their training.

Claims support or adjuster - Personal Lines

Claims support staff or adjusters help people when something has gone wrong, like a car accident or house fire. If you work in personal lines, you often deal with individuals and families going through a stressful time. This role requires compassion, problem-solving skills, and effective communication. Some claims roles are fully remote, while others might require occasional field visits depending on the company.

Personal Lines Underwriter

Underwriters in personal lines review applications for policies like auto or homeowners insurance and decide whether to approve them, how much to charge, and under what conditions. This low-interaction role is great for detail-oriented professionals and is often offered as a remote or hybrid position.

Personal Lines licensing assistant

This behind-the-scenes job supports insurance agents by keeping their licenses up to date and ensuring everything complies with state regulations. It’s a quieter, desk-based job perfect for those who are organized and enjoy structure.

Remote job opportunities in insurance

One of the best aspects of working in insurance today is that many roles can be performed completely remotely.

Common remote insurance jobs:

- P&C insurance jobs, such as Insurance Agent (Personal Lines or P&C), offer rewarding career paths with leading providers like Farmers Insurance and Nationwide Insurance.

- Customer Service Representative (CSR) roles are in high demand across insurance companies, providing essential client support in the P&C insurance sector.

- Claims intake or support specialist positions are vital roles in P&C insurance. They help streamline processes for major carriers and their customers.

- Underwriter opportunities are a key part of any insurance agency, undertaking risk assessment and ensuring policy accuracy.

- Licensing and compliance coordinator roles are critical for maintaining regulatory standards in P&C insurance jobs at top companies.

Why does insurance work so well remotely?

- Paperless policies: Most carriers now offer fully digital application and claims processes.

- Cloud-based systems: Tools like Salesforce, Zoom, and custom CRM platforms enable remote teams to stay connected.

- Self-service options for clients: Customers can file claims and make changes online, thereby reducing the need for in-person interactions.

- Virtual training: Many companies offer structured online onboarding for new employees.

What do you need to get started?

While you don’t need a degree in finance or years of experience to start in insurance, you do require a license to sell or work with insurance policies.

What licenses are required?

- Property and Casualty Insurance License: This license is required to sell or service both personal and commercial insurance policies. It encompasses a wide range of coverage areas, making it essential for anyone preparing for the property and casualty insurance exam.

- Personal Lines License: This license focuses exclusively on insurance products for individual clients, such as auto, renters, and homeowners policies. It does not cover commercial insurance.

Some states issue a separate Personal Lines license, while others include personal lines under the broader property and casualty insurance license. Before scheduling your property and casualty insurance exam, always verify your state’s specific licensing requirements.

How to get licensed:

- Take a pre-licensing course (required in most states).

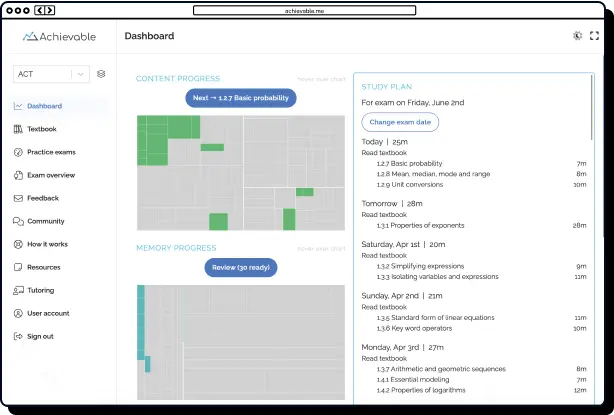

- Study using online platforms (like Achievable).

- Schedule and pass your exam.

- Apply for your license through your state’s insurance department.

Conclusion

Insurance is a popular career path for a reason. Pursuing P&C and personal lines insurance jobs can provide unmatched stability, flexibility, and meaningful connections with people. Whether you want to help families protect their homes or support businesses in navigating risk, careers in both P&C Insurance and Personal Lines offer substantial advancement potential. With many insurance companies offering remote work options, you have the freedom to develop your insurance career trajectory without compromising your lifestyle. If you’re seeking a reliable, rewarding, and remote-friendly field, a job in personal lines or P&C insurance can be your ideal next step.