How to start your own insurance agency

Table of contents

- Step 1: Get licensed

- Step 2: Choose your business model

- Step 3: Agency model

- Franchise model

- Field marketing organization (FMO) model

- Step 4: Registering your business

- Step 5: Secure capital

- Step 6: Build your client base

- Step 7: Invest in agency management systems

- Step 8: Stay updated on industry trends

- Conclusion

Are you interested in starting your own insurance agency? Entering the insurance industry is a smart move, as it offers stability and consistent growth opportunities. Individuals and businesses rely on coverage to protect what matters most to them, ensuring a steady demand for insurance professionals who can guide them through various products.

When exploring how to become an insurance agent, it’s critical to understand the role of an insurance agent and the crucial steps involved in starting to sell policies. Below are vital actions to take before you can successfully start your own insurance company, whether through an existing insurance firm or as an independent agent.

Step 1: Get licensed

To legally operate as an insurance agent and start your own agency, you’ll first need to take the specific insurance license exam for the type of insurance you plan to sell. Earning your license is a key step in how to become an insurance agent, whether you aim to specialize in Life and Health, Property and Casualty, or Personal Lines coverage. You must register for the appropriate state licensing exam and achieve a passing score to move forward in your insurance career.

For comprehensive information on preparing for each insurance license exam, explore our detailed guides for Life and Health (L&H), Property and Casualty (P&C), or Personal Lines Insurance. You can also use our insurance exam pass rates breakdown and insurance prelicensing requirements directory to find detailed statistics and requirements for your state.

Once you’ve passed your insurance license exam, you must officially apply for your state-issued license. Submit your application through your state’s insurance department or regulatory authority, ensuring that all required forms and documents are complete. The licensing process generally takes two to four weeks, depending on your state’s procedures and the accuracy of your submitted paperwork.

Following these necessary steps will put you on the right path toward a rewarding insurance career, whether you’re planning to operate as an independent or captive agent.

Step 2: Choose your business model

After obtaining your insurance license, the next step is selecting the right business model. There are two primary options:

- Captive agency: A captive agency represents a single insurance company exclusively, selling only that insurer’s products.

- Independent agency: An independent insurance agent operates their own agency and works with multiple insurance carriers, providing clients access to a wider variety of policy options.

Each path has unique advantages. Captive agencies benefit from comprehensive marketing support and training provided by their sole insurer; however, they may be limited by the company’s product offerings and pricing. Choosing to become an independent insurance agent offers greater flexibility and the ability to tailor coverage from different providers. However, it also requires managing several carrier relationships and staying updated on frequent product changes. Carefully weighing these models is essential for anyone interested in building a successful insurance business.

Step 3: Agency model

There are two main models most agencies operate under:

Franchise model

The franchise model can be attractive due to its benefits, such as up-and-running systems, lead generation, digital assets, a recognized brand, and resources to help grow the agency. It can be a good option for those who want to work independently yet remain part of a reliable organization. This model has some downsides due to its limitations on the agent, including non-compete clauses and regulations, high fees starting at $25,000, and the requirement of thousands of dollars in liquid capital.

Field marketing organization (FMO) model

The FMO model is similar to the franchise model and has grown in popularity in recent years. It includes perks such as assistance with marketing, lead generation, appointment scheduling with top insurance companies, and agency management tasks, including renewals, claim services, and other administrative details. However, the agent splits the commission with the agency instead of paying fees. The organization typically charges a 20 - 30% commission for new businesses and a 50% renewal commission.

Step 4: Registering your business

To legally operate when starting your own insurance agency, you must first complete these essential steps:

- Register your business name, making sure it complies with your state’s specific insurance agency naming requirements. Proper registration is crucial when starting your own insurance agency.

- Obtain all necessary business licenses, including the required state insurance company registration and any applicable bonds. Licensing is a foundational step in starting your own insurance company.

- Get an Employer Identification Number (EIN). This is needed for tax filings if your agency is set up as a corporation or partnership. If you’re forming an LLC, you may use your Social Security number instead when starting your own insurance agency.

- Secure professional liability insurance. Even when operating as an insurance company, you need to protect your business with the right coverage, such as errors and omissions insurance for professional liability claims. A Business Owner’s Policy (BOP) can also provide general liability insurance, property coverage, and business interruption protection.

Once you have completed these critical steps, you’ll be well-prepared for success in starting your own insurance agency and can move forward confidently with operations.

Step 5: Secure capital

Any insurance agency will require additional setup costs to cover basic business expenses, such as licensing, marketing, office space, and operational expenses. To get started with the basics, you could need anywhere from $5,000 to $50,000. The amount of start-up capital you’ll need depends on where you are based, whether you are renting office space or working from home, what type of marketing and lead generation strategy you choose, and what technology you invest in. Your funding needs will also depend on the type of agency and its model.

- Captive agencies may require lower upfront costs, but they could have more stringent production requirements.

- Independent agencies require more capital upfront for carrier contracts, marketing, and lead generation.

- Franchise models require significant investments, starting from $25,000, whereas FMO models operate on a commission split and have administrative expenses covered.

- Stock agencies may seek investor funding, while mutual agencies rely on policyholder contributions.

Here are a few options on how to fund your agency:

- Personal savings

- Crowdfunding: If you’re targeting a unique market niche

- Bank loans: These require a solid business plan and a good credit history

- Investor funding: for stock-structured agencies

Step 6: Build your client base

Finding clients is one of the biggest challenges in starting an insurance agency. Here are a few strategies to consider:

- Buying a book of business: A book of business is a database of business clients or accounts. This can be a great start that will establish a base of clients and provide you with instant cash flow. However, this option requires an initial investment, typically one to three times the book’s annual revenue.

- Networking and referrals: Building partnerships with real estate agents, mortgage brokers, and financial advisors can generate a steady stream of business leads.

- Online marketing: Utilizing SEO, Google My Business, and social media platforms such as LinkedIn, Instagram, X (formerly Twitter), and Facebook.

- Traditional advertising: Depending on your target audience, newspaper ads, radio spots, and direct mail campaigns may be good options.

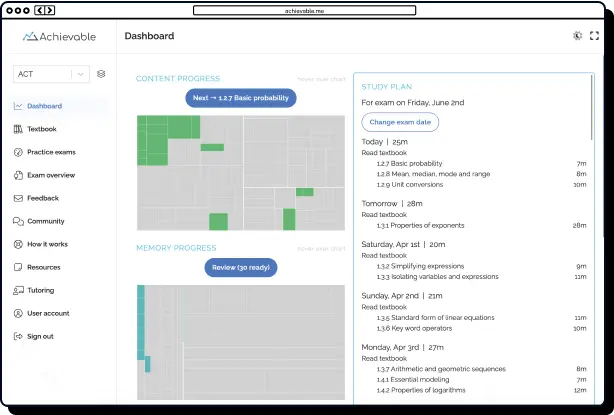

Step 7: Invest in agency management systems

Customer relationship management (CRM) systems can enhance efficiency by automating specialized tasks, such as policy renewals and client communication, as well as tracking sales and commissions. Software is typically designed to comply with state laws and can be a valuable aid when starting your business. This software can range from $50 to $300 per month, so only invest in this if it brings you added value.

Step 8: Stay updated on industry trends

This is vital to your long-term success. Monitoring the market, new technology, and customer preferences will prepare you for continued success.

Conclusion

Starting your own insurance agency requires careful planning, substantial investment, and a commitment to ongoing education. From obtaining the appropriate licensing needed to become an insurance agent to selecting the right business model, every step matters in building a profitable and sustainable venture. With a strong foundation in regulatory requirements and a solid client acquisition strategy, you’ll be well-equipped to establish and maintain your own insurance company and thrive in today’s competitive marketplace.