Remote insurance jobs: your career guide

Table of contents

- Why work in insurance?

- Why are remote insurance jobs a win?

- Top remote insurance careers

- Insurance sales agent

- Claims adjuster/Claims specialist

- Customer service representative

- Underwriter

- Insurance transcriptionist or data entry specialist

- Actuary

- Skills and tools required

- Hard skills

- Soft skills

- Licensing

- How to get started

- Is a remote insurance job right for you?

- Final thoughts

Let’s be honest: the idea of work-from-home insurance jobs sounds pretty great. No long commutes, no traffic jams, and the ability to build a serious, rewarding career in a stable field. The insurance industry isn’t just for people in suits walking through shiny office buildings anymore. Thanks to technology and a growing shift toward remote work, many high-demand insurance roles can now be performed entirely from home.

Let’s explore the best remote insurance jobs you can do from anywhere, and how you can start building your career in insurance today.

Why work in insurance?

Before we get into the remote side of things, let’s explore why work in insurance stands out as a smart career choice:

- It’s always in demand. People consistently need coverage for health, auto, life, and property insurance.

- This field offers lasting job security. Insurance remains a recession-resistant industry you can count on.

- An insurance license opens doors. Many positions don’t require a college degree. If you’re ready to learn and earn your license, opportunities are available.

- There’s strong potential for advancement. Whether you start in entry-level customer service or progress toward senior underwriting, a clear upward path exists.

Furthermore, pursuing a career in insurance is genuinely meaningful. You’re helping people protect what matters most: their health, homes, income, and long-term peace of mind, making every insurance license even more valuable.

Why are remote insurance jobs a win?

Working from home in insurance is becoming one of the most sought-after career paths. Remote insurance jobs are rising in popularity, and for good reason. Here’s why insurance work from home is such a great fit:

- Flexibility. With remote insurance jobs, you can set your own hours and work around your life.

- Minimal setup required. For most insurance work-from-home positions, all you need is a laptop, headset, and reliable internet.

- Comfort and convenience. Enjoy savings on gas, meals, and clothing, and reduce your daily stress by working remotely.

- Stay connected. Even in remote insurance roles, collaboration tools like Zoom, Slack, and advanced CRMs help you feel like part of a team.

- Family-friendly environment. Many parents, caregivers, and students find that remote insurance jobs offer the ideal balance for managing personal responsibilities.

Whether you’re introverted, juggling another part-time role, or simply prefer your own workspace, remote insurance opportunities provide real flexibility and career growth. WFH insurance jobs are a genuine pathway to a rewarding and adaptable profession.

Top remote insurance careers

Insurance sales agent

Sales could be a great fit if you’re confident talking to people and explaining things clearly.

- Sell policies over the phone or video.

- Usually requires a state license, like Life & Health or Property & Casualty, obtained by passing a state exam.

- Commission-based or base plus bonuses.

- Remote-friendly with the right tech tools (CRM, phone system, etc.).

Additionally, many companies provide leads, so no cold calling!

Claims adjuster/Claims specialist

When someone files an insurance claim, say, after an accident or a medical procedure, the claims adjusters investigate and decide what’s covered.

- Review documents, photos, or videos.

- Conduct interviews (via phone or Zoom).

- Decide if and how much the insurer should pay.

- Many companies offer fully remote claims roles, especially for property and medical claims.

Some roles may require a license, but many companies offer training to support their employees.

Customer service representative

This is one of the easiest ways to get into insurance remotely and a great stepping stone.

- Answer calls and emails.

- Help customers with policy changes, questions, billing, and claims.

- Requires good communication and empathy.

- Often, no license is required to get started.

Underwriter

If you’re more of a behind-the-scenes person and love working with data, this one’s for you.

- Analyze risks to decide whether to approve a policy.

- Use software to calculate coverage levels and premiums.

- Strong analytical skills are needed.

- Many underwriting roles are now fully remote or hybrid.

It is perfect for detail-oriented people who enjoy numbers and logic.

Insurance transcriptionist or data entry specialist

These roles are ideal for individuals who are fast, accurate, and prefer solo work.

- Type up reports, claim summaries, or call transcripts.

- Update customer records or process applications.

- Often flexible hours and freelance or contract-based work.

No phone calls. No sales. Just focused work you can do on your own schedule.

Actuary

If you’re into statistics, trends, and modeling risk, actuarial work is rewarding and well-paid.

- Requires strong math skills and actuarial certifications.

- Analyze data to help insurers set prices and predict risks.

- Many actuaries work remotely, especially at national firms.

This one takes time and training, but pays off in a big way.

Skills and tools required

Hard skills

- CRM systems (like Salesforce)

- Typing and data entry

- Insurance software (varies by role)

Soft skills

- Communication

- Time management

- Empathy

- Problem-solving

Licensing

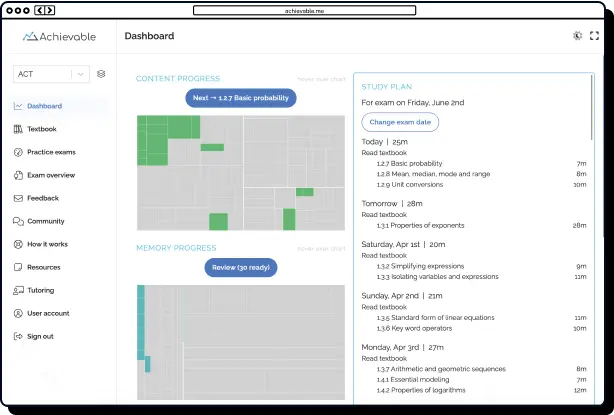

Most sales, adjuster, or underwriting positions require a valid insurance license to operate in your state. To pass your insurance license exam on the first try, prepare with online courses like Achievable’s Insurance License Exam Prep, which offers simple, easy-to-follow lessons that make complex topics understandable. Gaining the right insurance license meets legal requirements and builds your credibility as a professional.

How to get started

Here’s a simple 5-step plan to launch your remote insurance career and succeed in the insurance license exam process:

- Pick your path. Decide on an insurance role that matches your skills and personality.

- Review insurance license requirements. Visit your state’s official insurance licensing page to find out what type of insurance license and exam you’ll need.

- Prepare for the insurance license exam. Study efficiently using test prep tools like Achievable, so you’re ready to pass your state’s required insurance exam.

- Polish your resume. Showcase your remote work skills, strong communication abilities, licenses, and genuine interest in the insurance industry.

- Apply! Visit job boards such as Indeed, Remote.co, LinkedIn, or go directly to insurance companies’ websites to find remote openings for those with an insurance license.

By following these steps, you can smoothly transition into a rewarding remote insurance career, starting with your insurance license exam preparation.

Is a remote insurance job right for you?

Let’s keep it real: working from home isn’t just about sipping coffee in your PJs. You need:

- Discipline to stay focused.

- Self-motivation to meet deadlines.

- Clear communication over the phone and email.

- Comfort with technology.

But if you love flexibility, working independently, and making a real difference, this could be the perfect career path.

Final thoughts

Remote insurance jobs aren’t just possible, they’re quickly becoming the new standard in today’s evolving workplace. Whether you want to start a new chapter, change your career path, or finally land a position that complements your lifestyle, remote insurance jobs provide genuine opportunities to work from home while making a significant difference in people’s lives.

In insurance work-from-home roles, you do more than just sell policies or respond to customer calls. You help new parents protect their child’s future, support individuals through unexpected accidents, and offer families peace of mind when life gets tough. This is important work, and thanks to the growth of remote insurance jobs, you can do all of it from your kitchen table, favorite neighborhood café, or a quiet home office.

With the proper digital tools, some patience, and solid preparation, you can get licensed, secure a position in insurance, and build a flexible, rewarding career that’s ready for whatever the future holds. No matter if you’re living in a bustling city or a small rural town, the world of remote insurance jobs is wide open and waiting for you.