Insurance licensing inIllinois

Insurance licensing in Illinois

Interested in learning how to get an insurance license in Illinois? Below, you'll find prelicensing and exam information to help you get started. Get a head start on your insurance career by reviewing rules and regulations, education requirements, and exam offerings.

Find your state's license requirements

Contact your state insurance department

Illinois Department of Insurance 320 West Washington Street Springfield, IL 62767 Phone: (217) 782-6366 Website: https://idoi.illinois.gov

Does Illinois require prelicensing education?

Illinois requires producer licensing candidates to take and complete a state-approved prelicensing course. Potential agents must complete 20 hours of education and 7.5 of those hours must be completed in a classroom or web class. You will also need to apply to your license with the state insurance department and register for the state licensing exam. Make sure to register for all 3 (prelicensing course, license application, state exam) using the personally identifiable information exactly as it appears on your government-issued ID. Discrepancies will delay the licensing process.

How do I get my insurance license?

- Step 1: Complete a Department of Insurance-approved prelicensing course. After finishing, Achievable will confirm your completion of the required classroom portion and exam. The Certificate of Completion is valid for 1 year, so it’s advisable to complete the licensing process within 6-9 months.

- Step 2: Schedule your exam with Pearson VUE. You can book online at [https://www.pearsonvue.com/il/insurance/] or call (800) 274-0402. Choose between an in-person exam at a Pearson VUE center or a remote online proctored exam.

- Step 3: On exam day, bring two valid government-issued IDs (e.g., driver’s license, passport), including one with a photo. Also, carry your signed Certificate of Completion. Without these, you won't be allowed to take the exam. If testing at a Pearson VUE site, you’ll get your score report on-site. For online tests, access the score through your Pearson VUE account.

- Step 4: Apply for your license at least 5 days after passing your exam. Submit your application online at https://nipr.com/.

Insurance exam information

Illinois Life Insurance Examination

Illinois Accident and Health Insurance Examination

Illinois Property Insurance Examination

Illinois Casualty Insurance Examination

Licensing fees

- Initial individual fees: Resident Producer $215, Resident Limited Lines $0, Resident Surplus Lines $400; Nonresident Producer $380, Nonresident Limited Lines $0, Nonresident Surplus Lines $400

- Renewal fees: Resident Producer $215, Surplus Lines $400; Nonresident Producer $380, Surplus Lines $400, Nonresident Limited Lines $200

Citizenship requirements

Pre-license education required; fingerprints not required; US citizenship not explicitly required

Where to apply for a resident license?

Carrier appointments and terminations

- Required to report appointments: No, Registry (except limited lines and travel producers)

- Can be processed via NIPR: No

- Fees for appointing resident agency or individual: $0

- State requires appointment renewal: No – Registry

- Registry renewal period for limited lines: Nov 3 – Jan 2

- Appointment renewal fee: Limited Lines Producer $50

- Email notices permitted for not-for-cause terminations

Termination details

- Termination reasons: Cancelled, cancelled for cause

- Allows carriers to terminate if license expired: No

- Not-for-cause notices: Email permitted

Renewals

Resident renewal period begins: 90 days before expiration ; Resident renewal date: Last day of birth month every 2 years based on year of first state license ; Nonresident renewal period: 90 days before expiration ; Nonresident renewal date: Last day of birth month every 2 years based on year of first state license

Continuing education

- Total CE hours per renewal period: 24

- Renewal period: 2 years

- CE due before license renewal: Yes

- License renewal date: Last day of birth month

- Ethics: 3 hours classroom

- Flood: 3 hours NFIP (one-time)

- LTC: 8-hour initial, 4-hour per cycle

- Annuity: one-time 4-hour course

- Rollover allowed: 12 non-ethics credits

- CE exemptions: Certain limited and surplus lines agents, first renewal may vary

- Check CE transcripts: NAIC CE Lookup

How to get an insurance license

Pursuing a career as an insurance agent is an excellent opportunity for anyone seeking a client-facing, flexible, and rewarding professional path. As an agent, you'll help clients establish a financial safety net and safeguard what matters most to them.

Before you can begin working with clients and selling policies, there are certain actions you must take to become licensed in your area of practice. We've outlined the basic steps below:

General requirements

As mentioned, insurance license requirements vary from state to state, but the general process includes:

- Completing an approved prelicensing course (usually 20 - 40 hours) to prepare for your insurance license exam

- Registering for the appropriate licensing assessment online and paying the required fee

- Passing the state-administered exam with a minimum score of 70% or higher

- Undergoing a background check as part of your application process

- Submitting your application for an insurance license in your state

While not mandatory for licensing, having a college degree can be beneficial for your career, as many roles will require one to apply. A degree in business, finance, or marketing provides a strong foundation for exam and professional success. Though not a requirement in all states, taking an approved course on insurance fundamentals prior to the exam is also an important part of the licensing process.

Education requirements

In many states, completing an insurance prelicensing course is necessary to apply for a license. Pre-exam courses are often mandated because they equip agents with the vital regulatory, industry, and compliance knowledge required of the profession. A certificate of completion from an approved course must be submitted to the state's board of insurance to move your application forward.

The states that do require a certificate of completion are:

- Arkansas

- California

- Colorado

- Connecticut

- Florida

- Georgia

- Illinois

- Indiana

- Kentucky

- Michigan

- Minnesota

- Mississippi

- New Jersey

- New York

- North Carolina

- Ohio

- Oregon

- Pennsylvania

- West Virginia

- Wisconsin

States that do not require a certificate of completion for an insurance license course include:

- Alabama

- Alaska

- Arizona

- Delaware

- District of Columbia

- Hawaii

- Idaho

- Iowa

- Kansas

- Louisiana

- Maine

- Maryland

- Massachusetts

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Mexico

- North Dakota

- Oklahoma

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Wyoming

State-approved training courses ensure that candidates are prepared for their specific assessment, as the structure and content of each test vary by state and license type, and provide the insights needed to achieve a passing score. Even if your state does not require pre-exam coursework, enrolling in a test prep program is highly recommended.

Insurance licensing exams

Passing an insurance exam demonstrates a foundational understanding of insurance regulations, ethics, and product types. All exams include general content on insurance products, contract annuities, the underwriting processes, and the fundamentals of insurance transactions, which are fairly consistent across jurisdictions. A smaller portion of the test will cover state rules and regulations. The total number of questions and the time allotted for each exam will differ based on insurance line and the state administering the test.

Insurance licensing exams for all lines are notoriously tricky, with pass rates of just over 60% for many state exams. Prelicensing education helps develop a strong knowledge base, and intentional self-studying can further strengthen your preparation. If you plan on taking a prep course, ensure that you invest in a program that covers state-specific regulations and includes high-quality study materials.

Continuing education

After completing all the steps above and registering as an agent in your state, your license will remain valid for approximately two years. To maintain your certification, you must comply with state-specific continuing education (CE) requirements and renewal statutes. If you do not adhere to state rules regarding renewals, you will become ineligible to sell insurance products. Services like the National Insurance Product Registry (NIPR) make the process of applying to and renewing insurance licenses more streamlined, helping you keep track of each requirement no matter where you're located.

Before applying for an insurance license, it's a good idea to review your state's policies and prepare yourself for the application process. You should always verify requirements with your jurisdiction's registering authority as you progress through each step.

Frequently asked questions (FAQs)

What does an insurance agent do?

An insurance agent works with both commercial and non-commercial clients to select and purchase insurance products tailored to their specific needs. They provide expert advice on coverage options and strategies for minimizing financial risk. Agents consider clients' unique situations, financial goals, and risk tolerances to inform policy recommendations.

A standard day for an agent may involve meeting with clients, following up with leads, performing administrative tasks, and preparing insurance quotes. Agents may specialize in areas such as health, life, property, or auto insurance and assist with policy renewals, claims processes, and updating plans. A role in insurance remains a fantastic option for self-starters and those with keen analytical and communication skills. Whether agents work directly for a company, as part of an agency, or independently, they serve as reliable intermediaries between carriers and policyholders.

Captive insurance agents vs. independent insurance agents

Captive agents work for specific companies, such as Allstate or Geico, and receive a salary and bonuses. Independent agents are either self-employed or contracted by an organization, earning money solely through commissions. Independent agents are permitted to have agreements with multiple insurance companies, allowing them to offer an extensive suite of products. While captive agents are limited to selling their company's offerings, they benefit from more stable work conditions, training opportunities, and consistent clientele and income. The independent route is the less structured and riskier option, but it affords agents more autonomy and a greater earning potential for those highly adept at sales.

What are the different types of insurance?

Insurance coverage enables policyholders to shelter themselves and their dependents from financial uncertainty. Covered events can range from major illness to property damage to liability claims, all of which can be costly without proper protection. While insurance is often associated with unforeseen incidents, such as accidents or weather-related emergencies, coverage can also help individuals pay for routine expenses, including expected medical costs.

Agents may be certified in one or more insurance lines and can help guide clients through various policies to determine the most suitable options for their needs. Common types of insurance and their respective licensing exams include:

- Life-only insurance exam: Required to obtain a life insurance license, this exam qualifies agents to sell plans that allow policyholders to designate financial dependents as beneficiaries after their death.

- Health-only insurance exam: This exam is necessary to obtain a health insurance license and sell medical coverage. Agents often work directly with businesses to select group health plans, but may also enroll individuals in private insurance policies or public programs.

- Life and Health (L&H) insurance exam: Some states offer a combined life and health insurance exam, which entitles agents the right to transact products from both lines.

- Property-only insurance exam: This exam grants the ability to sell policies that provide financial protection against loss or damage to significant assets. Homeowners and renters insurance fall under this category.

- Casualty-only insurance exam: This exam certifies agents to vend casualty insurance policies, which cover financial losses from liability claims and property damage. Auto insurance is a well-known product within this category.

- Property and Casualty (P&C) insurance exam: Candidates who pass the P&C insurance exam can earn a combined property and casualty insurance license, which authorizes them to sell both product lines.

- Personal Lines insurance exam: Passing the personal lines insurance exam enables agents to advise non-commercial clients, protecting them from losses resulting from property damage, injury, or death.

- General Lines insurance exam: Earning a general lines insurance license allows agents to offer a wide variety of insurance products. General lines include homeowners, auto, pet, creditor, and other types of insurance.

Note that this list represents the broad classifications of insurance most commonly used by individuals and corporations. Within each category are several subforms of insurance and product types, from jewelry to boat to long-term care insurance. Agents can choose to specialize in specific products, insurance areas, or customer segments, or offer a more general range of services.

What's covered on insurance licensing exams?

All exams cover the fundamentals of insurance, including key terms, policy details, line-specific information, and state laws and regulations. Each exam requires a thorough understanding of both insurance basics and the specific type of insurance being tested, as well as policies distinct to the state in which the license will be granted.

Can insurance agents be licensed in multiple states?

Yes, agents can register in more than one state and hold multiple licenses for various types of insurance. Some states share reciprocity agreements that make it easy for agents to expand their credentials across state lines. Please be aware that the application for non-resident licenses may require additional exams and courses, in addition to the standard application and fee.

The directory above allows you to access information on the format, length, and passing scores of insurance exams across the country, so you can review requirements for all states you're interested in.

What is the difference between an insurance agent, an insurance broker, and an insurance adjuster?

An insurance agent works for a particular carrier, or with several carriers, and sells policies directly to their customers. They primarily focus on presenting customers with different policy options, providing recommendations, and closing sales, although they can also assist clients in filing insurance claims and advocate on their behalf.

Insurance brokers directly represent clients, helping them compare insurance options and rates and shop around for the best policy. Their role is similar to that of a financial advisor or consultant, as they do not sell insurance themselves but rather guide consumers through their choices. Once a policy is chosen, brokers will direct the account to an agent, who can finalize the transaction.

An insurance adjuster's responsibilities are quite different from those of an agent or broker. Claim adjusters use the information provided in an insurance claim to calculate the insurance company's liability, taking into account supporting details like damage repair estimates, hospital records, or witness statements. When evaluating claims, an adjuster must determine the benefit owed to the insured based on the terms of their policy.

Adjusters are either hired directly by companies or work independently, and are typically salaried employees who may collect a fee based on the value of a claim. Agents and brokers are paid commissions by insurance companies based on their sales activity, in addition to receiving a salary if they are not independently employed. Brokers also charge clients an additional cost for their services, known as a broker's fee. Agents, brokers, and adjusters must all hold a valid license to practice in their respective states. Both brokers and agents are considered "insurance producers" and must first pass their state's insurance licensing exam to qualify for their roles.

Conclusion

Insurance agents play a crucial role in helping individuals and businesses protect their assets, plan for the future, and navigate life's uncertainties. They provide key advice to ensure clients are as protected as possible against accidents, health issues, and property damage, helping them make smart financial decisions along the way. By earning your license, you can begin building your client base and establishing yourself as a trusted insurance professional in your area.

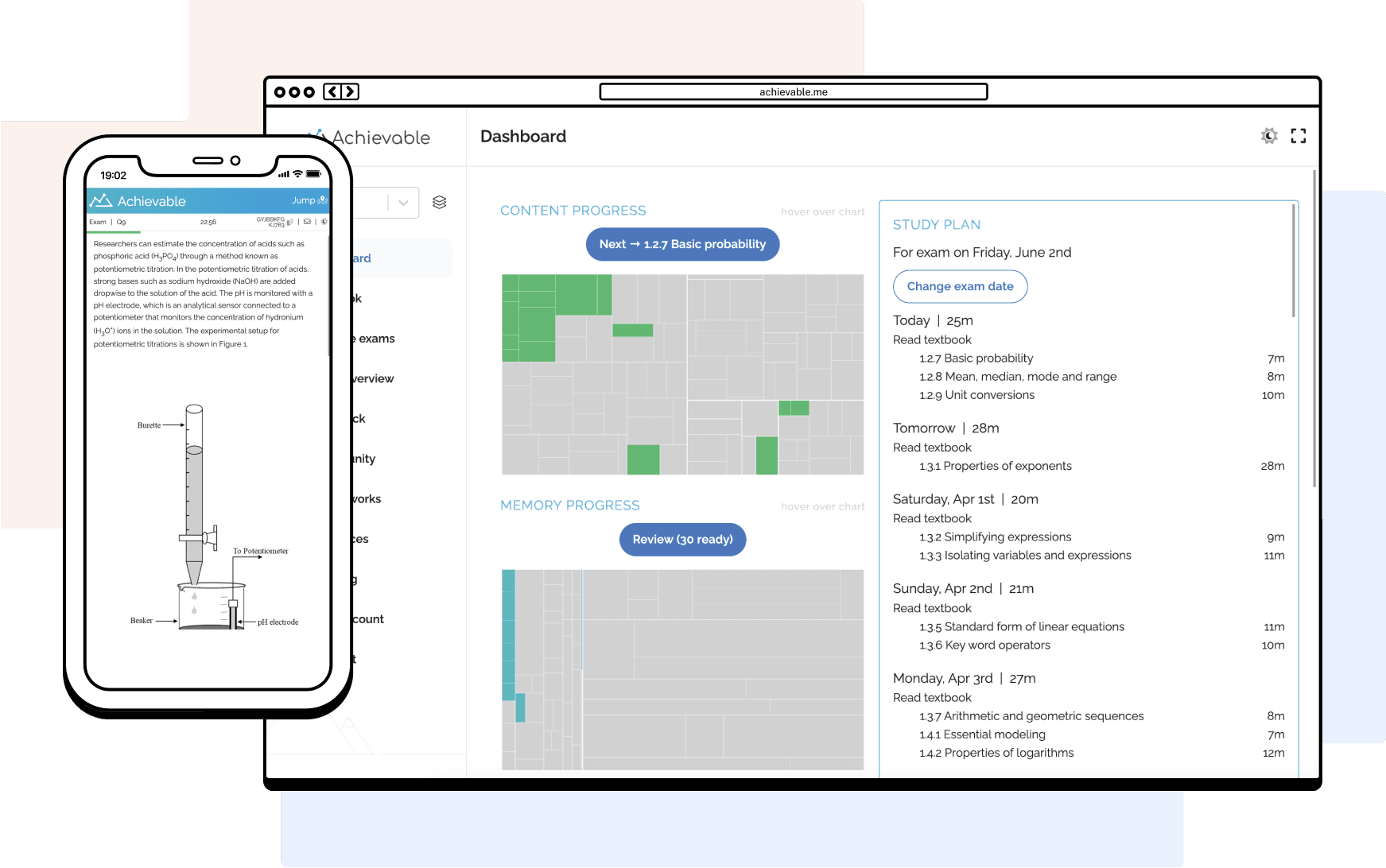

If you're ready to start your journey toward becoming a licensed insurance agent in Illinois, consider enrolling in Achievable's Life & Health Insurance course. Our comprehensive study materials and practice exams are designed to help you pass your licensing exam on the first attempt.

Interested in insurance licensing in other states?